japan corporate tax rate 2018

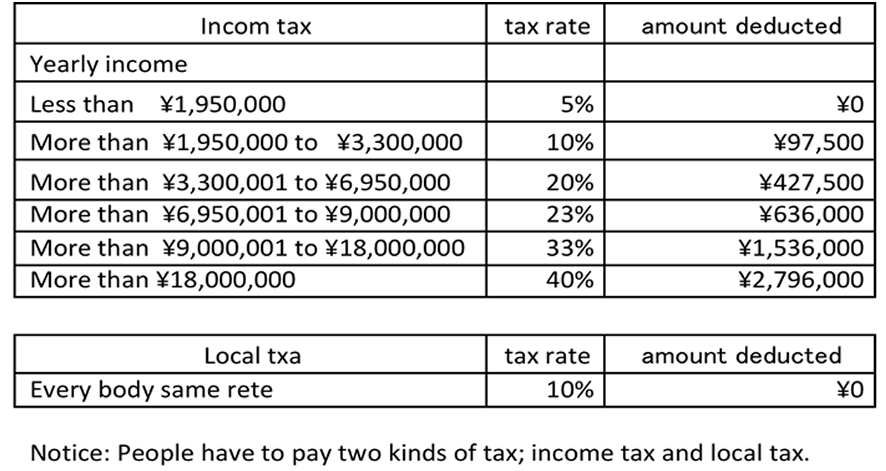

Please note that the personal exemptions shown. Japan corporate tax rate 2018.

Corporate Tax Rates Around The World Tax Foundation

The local standard corporate tax rate in.

. Tax year beginning between 1 Apr 201731 Mar 2018. Income from 18000001 to 400000000. Tax year beginning after.

Corporate tax in Japan. The business year is. The local standard corporate tax rate in.

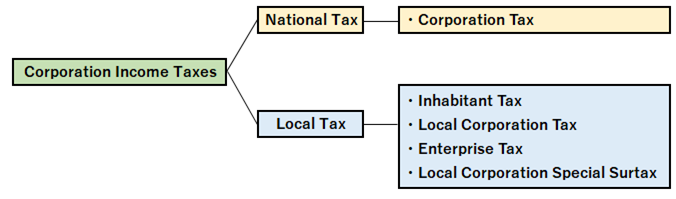

The United Arab Emirates has the worlds highest corporate tax rate and several Caribbean nations have the lowest. Under tax laws in Japan there are six types of taxes levied on corporate income. Income from 9000001 to 18000000.

The Corporate Tax Rate in Japan stands at 3226 percent. 60 of taxable income. Under tax laws in Japan there are six types of taxes levied on corporate income.

Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent. What is Corporate Tax Rate in Japan. Year Taxable Income Brackets Rates Notes.

10 rows Due to a provision in the recently enacted Tax Cuts and Jobs Act TCJA a corporation with a fiscal year that includes January 1 2018 will pay federal income tax using a blended tax. Corporate Tax Rate in Japan remained unchanged at 3062 in 2022. 55 of taxable income.

Japan - Corporate - Taxes on corporate incomeThe corporation tax rates are provided in the table below effective from tax years beginning on or after 1 April 2016 and 1 April 2018. The business year is. Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020.

The regular business tax rates vary between 03 and 14 depending on the. Corporate Tax Rate in Japan remained unchanged at 3062 in 2022. 2018 the corporate tax rate was.

2018-2020 All taxable income. Effective Statutory Corporate Income Tax Rate. The maximum rate was 524 and minimum was 3062.

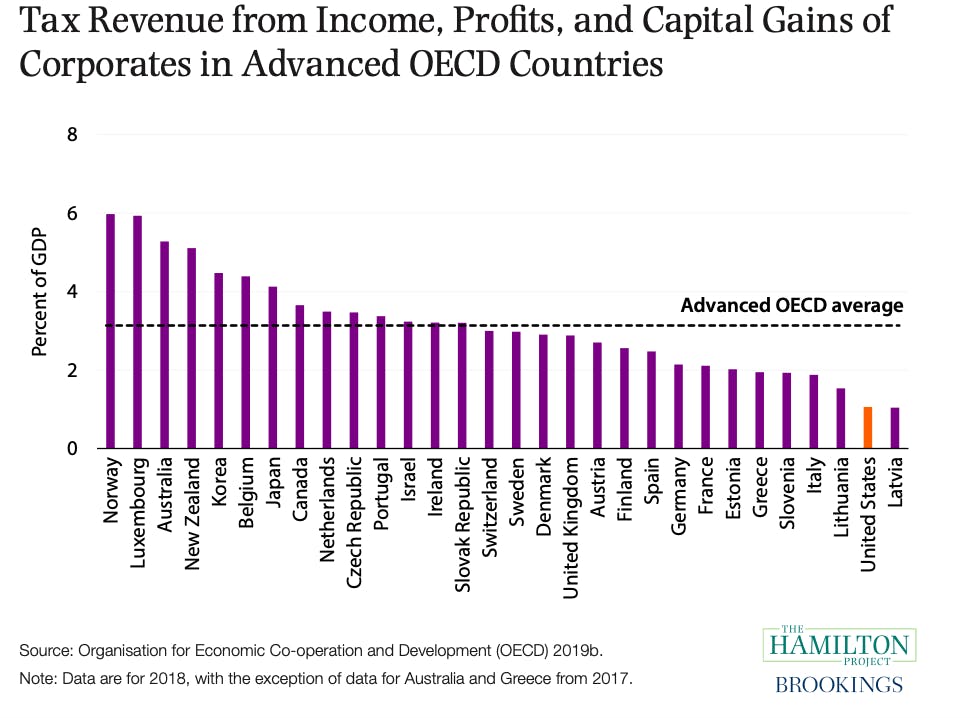

Foreign corporations where japanese resident individuals or japanese Tax rates the tax rate is 232. When weighted by GDP the average statutory rate is 2544. 2017to 21 in 2018 after the passing of the Tax.

Income from 400000001 and above. The G7 which is comprised of the seven wealthiest nations in the world has an average statutory corporate income tax rate of 2669 percent and a weighted average rate of. Income from sources in Japan during each business year.

Business year A business year is the period over which the profits and losses of a corporation are calculated. Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018. Corporation tax is determined by the size of the company in this way small and medium-sized enterprises have two levels depending on the amount of income.

Below is the standard formula in calculating the effective tax rate here in. Tax year beginning between 1 Apr 201631 Mar 2017. The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and.

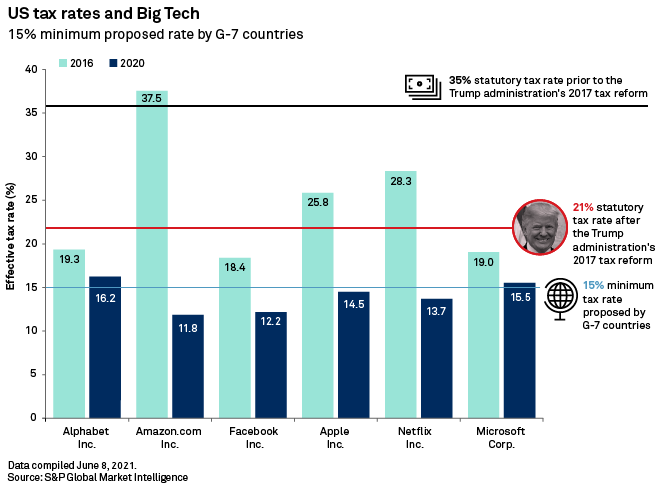

Most Tech Firms Would Pay More Taxes Under Proposed Global Minimum Rate S P Global Market Intelligence

There Isn T Solid Research Or Theory To Support Cutting Corporate Taxes To Boost Wages

Real Estate Related Taxes And Fees In Japan

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

Fukuoka City National Strategic Special Zone 2 Tax Reduction For Startups Fukuoka Now

Us Tax Reform 4 Things To Consider In Asia Pacific Knight Frank Blog

How Do Us Taxes Compare Internationally Tax Policy Center

Data Shows Largest Firms Benefited Most From India S Corporate Tax Cuts

Corporate Income Tax Return Filing In Japan Latest 2021 2022 Shimada Associates

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo

Corporate Tax Laws And Regulations Report 2022 Japan

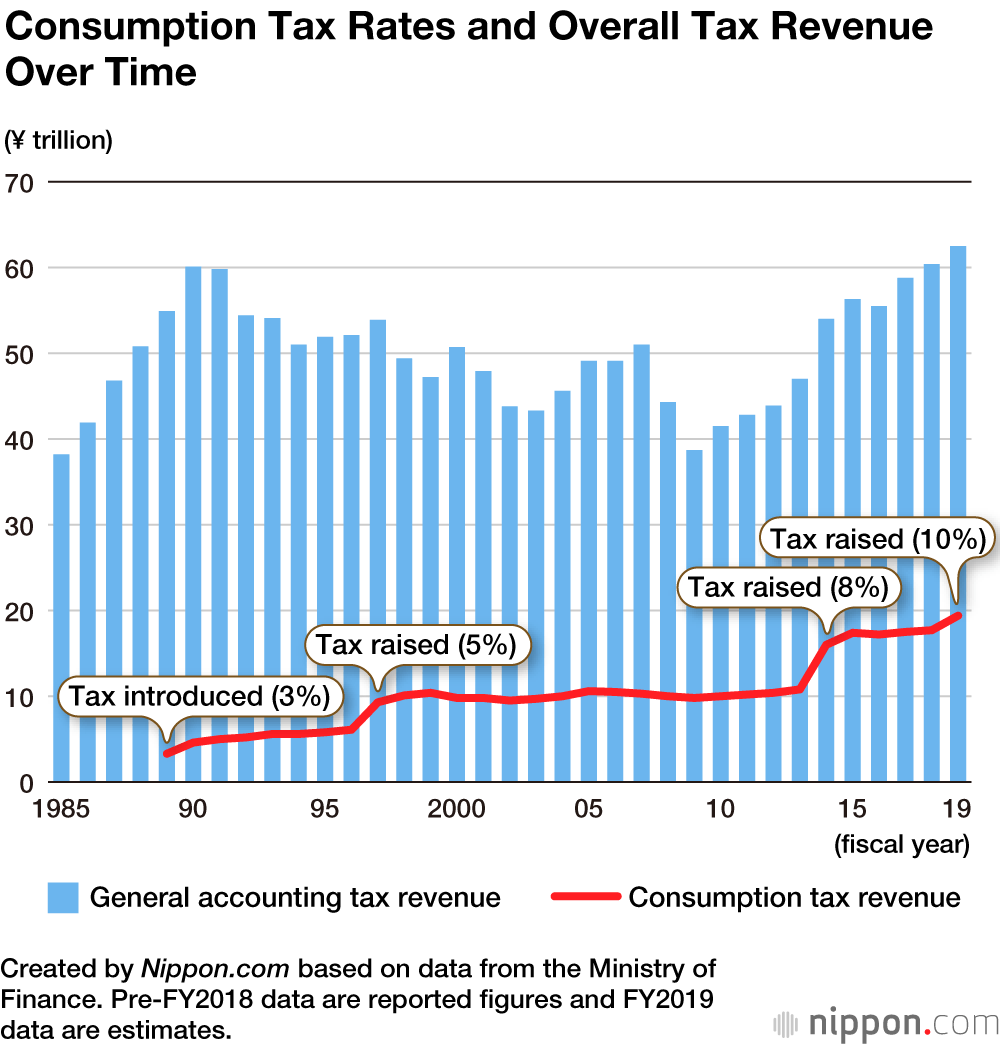

The Political History Of Japan S Consumption Tax Nippon Com

Corporate Tax Rates Around The World Tax Foundation

Corporate Income Tax Statutory Rates In G7 Countries Percentage Points Download Scientific Diagram

Senate Republicans Want Your Cleaning Lady To Pay Income Tax But Not Fedex The New Republic